Recession 2.0

- Aaron

- Blue Dragon Ninja

- Posts: 537

- jedwabna poszewka na poduszkę 70x80

- Joined: Sun Jun 05, 2005 6:44 pm

- Location: California

Recession 2.0

http://www.ft.com/cms/s/0/e6dd31f0-a133 ... abdc0.html

To summarize this article: a leading mainstream economist, (William White) who predicted in 2003 the economic crisis, is now saying we are in a W shaped graph. When asked if we are in a L shaped graph he basically said, I don't know but I wouldn't be surprised. He also says that none of the gov't. fixes actually solved any of the problems that caused the economic meltdown in the first place.

So basically we're in for a roller-coaster ride. Up and down, up and down.

So in your opinion how screwed are we?

Personally, I stand to lose nothing cause I literally own nothing that could be affected by the economy collapsing. In fact if I graduate early I probably stand to gain from all the plummeting prices of items.

But, all this doomsday talk has me wondering if anyone is actually doing something. I have heard of people buying pallets of ammunition for their weapons. While others have also purchased anywhere from a 30 day to a 6 month supply of food.

I haven't done anything like that but I don't think it would ever be necessary in the USA. I think elsewhere it might be a good idea to do that.

I have also heard reports that our nations supply of food (in case of a famine) is actually much lower then most people think and wouldn't last nearly long enough. But considering that we have the capability to switch to an overproduction of food in one season, I don't see it being a problem.

Anyway, I'd love to hear peoples thoughts and comments.

To summarize this article: a leading mainstream economist, (William White) who predicted in 2003 the economic crisis, is now saying we are in a W shaped graph. When asked if we are in a L shaped graph he basically said, I don't know but I wouldn't be surprised. He also says that none of the gov't. fixes actually solved any of the problems that caused the economic meltdown in the first place.

So basically we're in for a roller-coaster ride. Up and down, up and down.

So in your opinion how screwed are we?

Personally, I stand to lose nothing cause I literally own nothing that could be affected by the economy collapsing. In fact if I graduate early I probably stand to gain from all the plummeting prices of items.

But, all this doomsday talk has me wondering if anyone is actually doing something. I have heard of people buying pallets of ammunition for their weapons. While others have also purchased anywhere from a 30 day to a 6 month supply of food.

I haven't done anything like that but I don't think it would ever be necessary in the USA. I think elsewhere it might be a good idea to do that.

I have also heard reports that our nations supply of food (in case of a famine) is actually much lower then most people think and wouldn't last nearly long enough. But considering that we have the capability to switch to an overproduction of food in one season, I don't see it being a problem.

Anyway, I'd love to hear peoples thoughts and comments.

- Jenner

- Dragonmaster

- Posts: 2307

- Joined: Thu Dec 26, 2002 1:24 am

- Location: Happily ever after

- Contact:

Re: Recession 2.0

My personal opinion on this is that most of the reason the economy has been up and down is based solely on the strength and capacity of the working and middle class. As the gap between poor and middle class becomes more and more insignificant, the economic rebounds will have less staying power in general. The arteries that run the economy are the common people who make the most normal purchases. You can't run an economy on gourmet food, yachts and private planes. As the middle class gets weaker, more exploited and more disenfranchised so will the economy. But, if the middle class is enabled to the point of being upper class then we have no economy.

I am not an economist, but Kizyr is. I know for a fact that all this fear mongering is just that, fear mongering. At the same time, I won't deny that the economy is is a bad place. But, we are fools if we think that is the fault of the current administration. This recession was beginning to show at the end of the Clinton Years when the Dot.Com bubble burst. If we keep trending our economy by bubbles it's not going to be a fun thing.

We need to start investing and focusing our economy on solid and permanent markets instead of jumping on every fad. Most importantly, we need to stop war profiteering. We're at an age and technology now where we've turned the curve on profit vs cost in a war. Getting into the kind of combat that would require true profit from the budget we're investing in military would require starting a brawl with an enemy that is just as capable of handing us our asses as we are. The real reason that America is constantly in conflicts and mongering wars is because that is how we've kept our economy going strong since before World War 1.

But investing in conflict and bloodshed is no longer a route we can take because, other than the reasons I've stated above, the military contracting and weapons and armor creation industries have become as glutted and self-righteous as the health insurance companies. When it costs the salary of what two soldiers would make in a year to drop a bomb on a group of poor, dehydrated, flea-bitten, desperate militants in some backwater despotic country it stops becoming profitable.

It's doing more damage to us than good for us, not just financially, but socially. Every time our checkbooks get a little red, we start some brawl with the fat kid on the playground and steal his lunch money. We haven't made an economic profit on a war since Korea. At least, not one that reflected onto the general populous. (The private contractors with their no-bid contracts and their getting paid for things they didn't make or give to our soldiers are rolling in loot.)

America sells the most guns, and the most war technologies. But, we're starting to get on the receiving end of what our corporations are doing to us now. We made a mint selling weapons to Israel and Burma and other countries (We even sold weapons to Iraq, and China, we're weapons traders, we've sold them to everyone.) But those countries had smart people too, they reverse engineered our technology and now THEY make weapons that are just as good, if not better, than ours. They make it cheaper, and sell it cheaper.

And no, we can't compete, and we shouldn't. Because, this late in the game, It's no longer about competition anymore. The pool is full of piss and blood and it's time to stop swimming in it. Unfortunately, The -Fatal Hopper- In Charge are afraid to abandon their old cash cow, (especially when it's their businesses, their investors, their corporations and their money/income on the line. And don't think otherwise.) Even when the cow is dead.

So, yes Aaron, the economy is going to keep fluctuating. And it's going to peak lower when it peaks and dip deeper each time it dips. But, the end times for us financially won't happen now, it'll happen at the end of our generation's life span, maybe. And since it's not our problem that we don't have to live with, why worry about it. Am I rite? (please note the sarcasm.)

It's not something WE can change.

The recession appears to be over anyway

USA leads in foreign gun sales.

I am not an economist, but Kizyr is. I know for a fact that all this fear mongering is just that, fear mongering. At the same time, I won't deny that the economy is is a bad place. But, we are fools if we think that is the fault of the current administration. This recession was beginning to show at the end of the Clinton Years when the Dot.Com bubble burst. If we keep trending our economy by bubbles it's not going to be a fun thing.

We need to start investing and focusing our economy on solid and permanent markets instead of jumping on every fad. Most importantly, we need to stop war profiteering. We're at an age and technology now where we've turned the curve on profit vs cost in a war. Getting into the kind of combat that would require true profit from the budget we're investing in military would require starting a brawl with an enemy that is just as capable of handing us our asses as we are. The real reason that America is constantly in conflicts and mongering wars is because that is how we've kept our economy going strong since before World War 1.

But investing in conflict and bloodshed is no longer a route we can take because, other than the reasons I've stated above, the military contracting and weapons and armor creation industries have become as glutted and self-righteous as the health insurance companies. When it costs the salary of what two soldiers would make in a year to drop a bomb on a group of poor, dehydrated, flea-bitten, desperate militants in some backwater despotic country it stops becoming profitable.

It's doing more damage to us than good for us, not just financially, but socially. Every time our checkbooks get a little red, we start some brawl with the fat kid on the playground and steal his lunch money. We haven't made an economic profit on a war since Korea. At least, not one that reflected onto the general populous. (The private contractors with their no-bid contracts and their getting paid for things they didn't make or give to our soldiers are rolling in loot.)

America sells the most guns, and the most war technologies. But, we're starting to get on the receiving end of what our corporations are doing to us now. We made a mint selling weapons to Israel and Burma and other countries (We even sold weapons to Iraq, and China, we're weapons traders, we've sold them to everyone.) But those countries had smart people too, they reverse engineered our technology and now THEY make weapons that are just as good, if not better, than ours. They make it cheaper, and sell it cheaper.

And no, we can't compete, and we shouldn't. Because, this late in the game, It's no longer about competition anymore. The pool is full of piss and blood and it's time to stop swimming in it. Unfortunately, The -Fatal Hopper- In Charge are afraid to abandon their old cash cow, (especially when it's their businesses, their investors, their corporations and their money/income on the line. And don't think otherwise.) Even when the cow is dead.

So, yes Aaron, the economy is going to keep fluctuating. And it's going to peak lower when it peaks and dip deeper each time it dips. But, the end times for us financially won't happen now, it'll happen at the end of our generation's life span, maybe. And since it's not our problem that we don't have to live with, why worry about it. Am I rite? (please note the sarcasm.)

It's not something WE can change.

The recession appears to be over anyway

USA leads in foreign gun sales.

The Infamous Jenner!

Maker of Lists.

RIP Coley...

still adore you Kiz.

Maker of Lists.

RIP Coley...

still adore you Kiz.

- Ruby

- Black Dragon Wizard

- Posts: 361

- Joined: Wed Dec 25, 2002 5:22 am

- Location: The plane of Archon

- Contact:

Re: Recession 2.0

I'd tell you it might be a good idea to invest in gold, except that if you get enough of it the government has a penchant for stealing it. Oh and yeah, we're boned. The bailouts are going to hurt us more in the long run than those companies failing ever could. Constantly trying to manipulate the market with government is going to make things get more and more imbalanced, constantly printing currency is going to make inflation rise, making the currency you own worth less and less every day, and since they have the idea in Washington that deflation is bad, it's just going to get worse and worse.

BTW, typically the cycle of recession I was taught was to expect one every 11 years. Due to the tinkering however the time between recessions is getting shorter and shorter. I mean they're occurring, what, one every 8 years now? Generally speaking a recession corrects a boom the market can't sustain. Business contract and consolidate, and prices drop, something that needs to happen. However we now use the government to stopping businesses from slowing and prices from dropping, allowing the underlying cause to continue to happen again once the previous band-aid fails. Eventually though they're going to run out of band-aids. I'm not entirely sure the problem will be at the end of our lifetimes, though. It's entirely possible we'll be unfortunate enough to see a major crash.

BTW, typically the cycle of recession I was taught was to expect one every 11 years. Due to the tinkering however the time between recessions is getting shorter and shorter. I mean they're occurring, what, one every 8 years now? Generally speaking a recession corrects a boom the market can't sustain. Business contract and consolidate, and prices drop, something that needs to happen. However we now use the government to stopping businesses from slowing and prices from dropping, allowing the underlying cause to continue to happen again once the previous band-aid fails. Eventually though they're going to run out of band-aids. I'm not entirely sure the problem will be at the end of our lifetimes, though. It's entirely possible we'll be unfortunate enough to see a major crash.

- Kizyr

- Keeper of Knowledge (probationary)

- Posts: 8319

- Joined: Wed Dec 25, 2002 7:36 am

- Location: Marius Zone

- Contact:

Re: Recession 2.0

It's pretty easy to say we're in a W-shaped recession. I mean, a W is literally two Us. We had a slowdown (maybe by some definitions a mini-recession) in the mid-2000s, and then when the housing market collapsed we went into a deeper one.

My company was predicting at the beginning of this year that we'd be at the bottom of the recession in September (turns out that, now that we're here, most US economists and the Federal Reserve seem to agree). That doesn't mean things will be back to normal or even improve soon, just that they shouldn't get substantially worse.

The benefit after a particularly bad recession is that governments tend to institute certain regulations to prevent it from happening again (another recession can still occur thanks to a new reason, though). After the Great Depression, for instance, we set standards that'll prevent a complete economic collapse due solely to the stock market (stopping trading automatically if stocks fall more than 10%, e.g., but this is only one example). After this, I'm sure we'll set rules regarding predatory lending practices--personally, I'd like to see something like a "borrowers' bill of rights" to mandate how lending contracts and terms are stipulated. In other words, no more hiding behind fine print or lying about the risks of a variable rate mortgage.

Those sort of rules, more than bailouts, are what'll mitigate against this type of recession happening again. Now, it could still happen to a lesser extent, and another recession or slowdown could be brought on by another as-yet-unseen reason.

* Actually, even if the world ended and we were in some post-apocalyptic wasteland, I'd put my money on cigarettes being the new form of currency sooner than gold. KF

My company was predicting at the beginning of this year that we'd be at the bottom of the recession in September (turns out that, now that we're here, most US economists and the Federal Reserve seem to agree). That doesn't mean things will be back to normal or even improve soon, just that they shouldn't get substantially worse.

The benefit after a particularly bad recession is that governments tend to institute certain regulations to prevent it from happening again (another recession can still occur thanks to a new reason, though). After the Great Depression, for instance, we set standards that'll prevent a complete economic collapse due solely to the stock market (stopping trading automatically if stocks fall more than 10%, e.g., but this is only one example). After this, I'm sure we'll set rules regarding predatory lending practices--personally, I'd like to see something like a "borrowers' bill of rights" to mandate how lending contracts and terms are stipulated. In other words, no more hiding behind fine print or lying about the risks of a variable rate mortgage.

Those sort of rules, more than bailouts, are what'll mitigate against this type of recession happening again. Now, it could still happen to a lesser extent, and another recession or slowdown could be brought on by another as-yet-unseen reason.

Not really. The last real US recession was in the early 1980s (using the technical definition of two consecutive quarters of negative growth). There were some slowdowns (early 1990s, dot-com burst, mid 2000s) but until 2008-2009 we didn't really have a recession. Furthermore, this recession is very different from the usual business cycle in magnitude. The dot-com burst and mid-2000s was that sort of size, but not the housing/credit market collapse.Ruby wrote:BTW, typically the cycle of recession I was taught was to expect one every 11 years. Due to the tinkering however the time between recessions is getting shorter and shorter. I mean they're occurring, what, one every 8 years now? Generally speaking a recession corrects a boom the market can't sustain.

Unless you're concerned that the government as a whole is going to collapse*, then gold is a poor investment compared to most any other type (stocks, bonds, etc.). Its value in real terms doesn't increase as substantially for long-term investments. Generally speaking, diversifying your investments (and this can include gold), and investing long-term rather than short-term, is a much better bet all around.Ruby wrote:I'd tell you it might be a good idea to invest in gold, except that if you get enough of it the government has a penchant for stealing it.

* Actually, even if the world ended and we were in some post-apocalyptic wasteland, I'd put my money on cigarettes being the new form of currency sooner than gold. KF

~Kizyr (they|them)

- Aquaignis

- Black Dragon Wizard

- Posts: 366

- Joined: Thu Jan 19, 2006 4:04 pm

- Location: Might's Tower...still...

- Contact:

Re: Recession 2.0

or bottlecaps...wtf were they thinking? lol

Some of the answers in this post are made of frozen lose with whipped failsauce topping and suck sprinkles......

Re: Recession 2.0

The chair fed said that we're out of the recession now. Guess that means its all roses.

I don't think anything is getting better or will get better for the people. Our GDP likes to grow and grow. And if you look at that aspect of the data then yes, we're not in trouble. But, I think there has been a steady decline in the standard of living, and I think part of it was brought upon us by cultural choices. Such as not valuing hard work, honesty, reliability. Another part of it is greed.

I don't think anything is getting better or will get better for the people. Our GDP likes to grow and grow. And if you look at that aspect of the data then yes, we're not in trouble. But, I think there has been a steady decline in the standard of living, and I think part of it was brought upon us by cultural choices. Such as not valuing hard work, honesty, reliability. Another part of it is greed.

- Jenner

- Dragonmaster

- Posts: 2307

- Joined: Thu Dec 26, 2002 1:24 am

- Location: Happily ever after

- Contact:

Re: Recession 2.0

LOL Fallout reference. Dogmeat is mine, -Meryod-.Aquaignis wrote:or bottlecaps...wtf were they thinking? lol

Cats have prepared for this crisis.

The Infamous Jenner!

Maker of Lists.

RIP Coley...

still adore you Kiz.

Maker of Lists.

RIP Coley...

still adore you Kiz.

- Ruby

- Black Dragon Wizard

- Posts: 361

- Joined: Wed Dec 25, 2002 5:22 am

- Location: The plane of Archon

- Contact:

Re: Recession 2.0

I enjoy how in in the same paragraph you say that the early 1990s, dot-com bust, and mid 2000s aren't recessions, something I think a lot of us, myself included, think of as recessions, and then at the end of the paragraph say they're the same magnitude as what one would expect a recession to be. Well which is it Kizzy? XDKizyr wrote:Not really. The last real US recession was in the early 1980s (using the technical definition of two consecutive quarters of negative growth). There were some slowdowns (early 1990s, dot-com burst, mid 2000s) but until 2008-2009 we didn't really have a recession. Furthermore, this recession is very different from the usual business cycle in magnitude. The dot-com burst and mid-2000s was that sort of size, but not the housing/credit market collapse.Ruby wrote:BTW, typically the cycle of recession I was taught was to expect one every 11 years. Due to the tinkering however the time between recessions is getting shorter and shorter. I mean they're occurring, what, one every 8 years now? Generally speaking a recession corrects a boom the market can't sustain.

The point of buying gold is primarily as a hedge against inflation since there's a real physical limit on the quantity of gold and gold has had a very long track record of being valuable, much longer than paper currency. Recently government spending increased sharply, the amount of money being printed has skyrocketed which means inflation is going to increase. A lot. Ergo, having money saved in gold in would be useful as gold is going to be immune to the effects of inflation (The supply of gold is pretty constant) and you only have to deal with the fluctuation of demand for gold, something which has a long history of being in high demand.Kizyr wrote:Unless you're concerned that the government as a whole is going to collapse*, then gold is a poor investment compared to most any other type (stocks, bonds, etc.). Its value in real terms doesn't increase as substantially for long-term investments. Generally speaking, diversifying your investments (and this can include gold), and investing long-term rather than short-term, is a much better bet all around.Ruby wrote:I'd tell you it might be a good idea to invest in gold, except that if you get enough of it the government has a penchant for stealing it.

* Actually, even if the world ended and we were in some post-apocalyptic wasteland, I'd put my money on cigarettes being the new form of currency sooner than gold. KF

A situation where the value of currency drops so much as to be nigh valueless, or the economy tanks and many business go under is not a post-apocalyptic end of days scenario, it's a situation that has come and gone in various regions throughout history. Just take a look at Germany after WWI or Zimbabwe currently. You don't need the entire country to collapse for a stock of savings in the form of gold to be valuable, though yes if you're looking to grow your wealth then stocks and bonds are going to be the way to go, because there you're not saving it, you're investing it and taking on some risk in the hope of getting a bigger return.

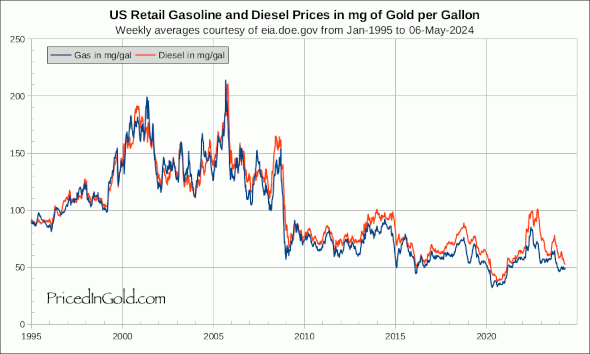

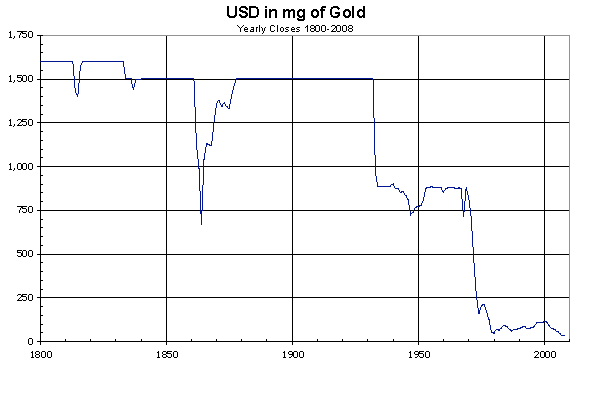

Here's something you might find interesting, BTW. First is the price of gas in mg of gold. Notice how it's not trending constantly upwards, because the cost of gasoline isn't actually rising constantly, but the currency you have is going down in value so it buys less gasoline. The next two graphs shows the value of the dollar measured in mg of gold. Behold as it plummets like a stone.

*Yes, in your post-apocalyptic scenario cigarettes, and other recreational drugs would probably be in high demand.

- Kizyr

- Keeper of Knowledge (probationary)

- Posts: 8319

- Joined: Wed Dec 25, 2002 7:36 am

- Location: Marius Zone

- Contact:

Re: Recession 2.0

Ok, pay attention to the terminology that I use. The terms that I use have specific meanings; I'm not throwing them around arbitrarily.Ruby wrote:I enjoy how in in the same paragraph you say that the early 1990s, dot-com bust, and mid 2000s aren't recessions, something I think a lot of us, myself included, think of as recessions, and then at the end of the paragraph say they're the same magnitude as what one would expect a recession to be. Well which is it Kizzy? XD

Recession = defined by two consecutive quarters of negative growth (negative growth means a decline in real GDP, not a decrease in the growth rate).

Slowdown = more general term, that can be either a recession or just slower growth (meaning a decrease in the growth rate over several quarters)

So, a recession is a "slowdown", but a "slowdown" is not necessarily a recession. It is possible to have a recession that doesn't technically fit the above definition, though that's usually determined after-the-fact.

If that isn't clear thus far, I'll break it down by years:

Early 1980s - unambiguously a recession, brought on by spikes in oil/energy prices and a few other factors most probably

Late 1990s/Early 2000s - slowdown, only a recession if you adopt a very broad definition of it, brought on by the dot-com bubble and subsequently 9/11

Mid-2000s - slowdown, not a recession

Currently - also unambiguously a recession, brought on by the housing market and credit market collapses

Even if you adopt a broad definition, the claim that recessions are getting more frequent than previous years is factually false.

When I said "the same magnitude", I was referring to the natural contract/expand business cycle you mentioned. A contracting business cycle is not the same as a recession; it does usually look like a slowdown, however. The mid-2000s slowdown had a diverse set of causes, though, beyond the usual cycle.

You've proven that gold is more valuable than stuffing money under a mattress. That much is true. But, I said gold was a poor investment. Most other long-term investments (stocks/mutual funds, bonds, IRAs, etc.) do much, much better than gold; only if you compare them in the short term is there any ambiguity (and if you notice in your own graphs, the same can be said for gold).Ruby wrote:The point of buying gold is primarily as a hedge against inflation since there's a real physical limit on the quantity of gold and gold has had a very long track record of being valuable, much longer than paper currency.

Also, I know full well the reasons for investing in gold. But, the only financial advisors who'd tell you to put most of your money in gold (or other commodities) are people who personally stand to profit from you investing in gold. Note that this doesn't preclude a diversified strategy including gold assets (which is implicit in using it as a hedge).

Fun fact: during the Weimar Republic's hyperinflation, cigarettes became de facto currency. So, using cigarettes as well isn't some post-apocalyptic scenario. Additionally, in the modern day, countries suffering from hyperinflation adapt by investing in foreign, more stable currencies (US dollars for Latin America, US dollars, Pounds, or Euros for Africa/Eastern Europe, Australian dollars for the Pacific, etc.). The benefit there is that something like the US dollar is far more accessible to the average person than gold. In an emergency, switching to foreign currency actually allows commerce to still happen; switching to gold arrests that commerce.Ruby wrote:A situation where the value of currency drops so much as to be nigh valueless, or the economy tanks and many business go under is not a post-apocalyptic end of days scenario, it's a situation that has come and gone in various regions throughout history. Just take a look at Germany after WWI or Zimbabwe currently.

Bottom line: gold by itself isn't a better hedge than a diverse investment portfolio and (in a pinch) foreign currencies.

As I said before, this only proves that gold is better than stuffing money under your mattress. In the long run, most any other long-term investment strategy is going to do you better than gold.Ruby wrote:Here's something you might find interesting, BTW. First is the price of gas in mg of gold. Notice how it's not trending constantly upwards, because the cost of gasoline isn't actually rising constantly, but the currency you have is going down in value so it buys less gasoline. The next two graphs shows the value of the dollar measured in mg of gold. Behold as it plummets like a stone.

Also, I'm really busy today (taking a bit of a break at the moment) and don't have time to go into a whole economics lesson. But, deflation is a very bad thing, particularly compared to moderate inflation (moderate being 1-3% annually or so). Deflation tends to be a symptom of slow growth, and slow down the rate of consumption and investment as consumers find it more worthwhile to hold onto money rather than spend or invest it. Japan has been dealing with deflationary pressures from about 1992 to 2007-2008; only recently has this begun to reverse. KF

~Kizyr (they|them)

Re: Recession 2.0

Look, Kizyr, I'm no economist, but I disagree with both you and Ruby. We should invest all of our money in silver. That way when Obama's secret healthcare retrovirus turns 90% of America's population into werewolves, we can melt down our silver to make bullets. This is fact.

- phyco126

- Dragonmaster

- Posts: 8136

- Joined: Fri Dec 27, 2002 3:06 am

- Location: Colorado Springs, Colorado, USA

Re: Recession 2.0

Actually, I'm hoping the healthcare virus thingy can turn me into a sparkly vampire.

- "Sometimes life smiles when it kicks you down. The trick is to smile back."

- Kizyr

- Keeper of Knowledge (probationary)

- Posts: 8319

- Joined: Wed Dec 25, 2002 7:36 am

- Location: Marius Zone

- Contact:

Re: Recession 2.0

Buryin' gold doubloons also seems to me a sound investment. KFWerefrog wrote:Look, Kizyr, I'm no economist, but I disagree with both you and Ruby. We should invest all of our money in silver. That way when Obama's secret healthcare retrovirus turns 90% of America's population into werewolves, we can melt down our silver to make bullets. This is fact.

~Kizyr (they|them)

- Nobiyuki77

- Legendary Hero

- Posts: 1329

- Joined: Tue Apr 01, 2003 5:16 pm

- Location: Wakayama, Japan

Re: Recession 2.0

I was going to say "and move to Lunar?", but that'd be too obvious. XDWerefrog wrote:Look, Kizyr, I'm no economist, but I disagree with both you and Ruby. We should invest all of our money in silver. That way when Obama's secret healthcare retrovirus turns 90% of America's population into werewolves, we can melt down our silver to make bullets. This is fact.

-Nobi

- Jenner

- Dragonmaster

- Posts: 2307

- Joined: Thu Dec 26, 2002 1:24 am

- Location: Happily ever after

- Contact:

Re: Recession 2.0

What kinna language are ye speaking thar, lubber?Nobiyuki77 wrote:I was going to say "and move to Lunar?", but that'd be too obvious. XDWerefrog wrote:Look, Kizyr, I'm no economist, but I disagree with both you and Ruby. We should invest all of our money in silver. That way when Obama's secret healthcare retrovirus turns 90% of America's population into werewolves, we can melt down our silver to make bullets. This is fact.

The Infamous Jenner!

Maker of Lists.

RIP Coley...

still adore you Kiz.

Maker of Lists.

RIP Coley...

still adore you Kiz.

- Nobiyuki77

- Legendary Hero

- Posts: 1329

- Joined: Tue Apr 01, 2003 5:16 pm

- Location: Wakayama, Japan

Who is online

Users browsing this forum: No registered users and 29 guests